epf withdrawal i sinar

The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1. On the next slider set your preferred first payout amount.

High Income Earners Withdraw Epf To Invest In Gold Stocks

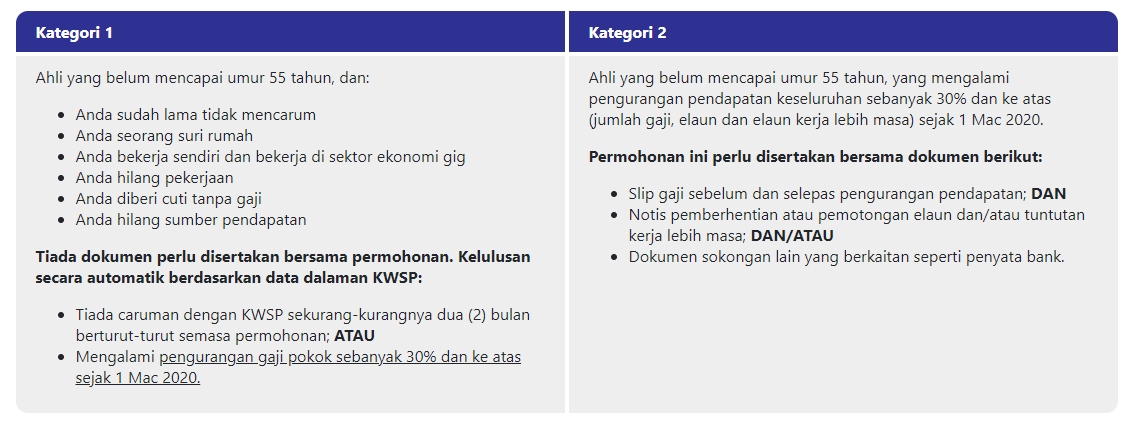

For members who fulfil the criteria their application will be approved automaticallyOnly confirmation of the maximum amount is required during members online application and is not difficult.

. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. The UCSI Research Center also found that repaying loans was the main purpose for respondents to make i-Sinar withdrawals for the B40 and M40 groups as well as those aged between 26 to 55 years. How much can you withdraw from EPF i-Sinar.

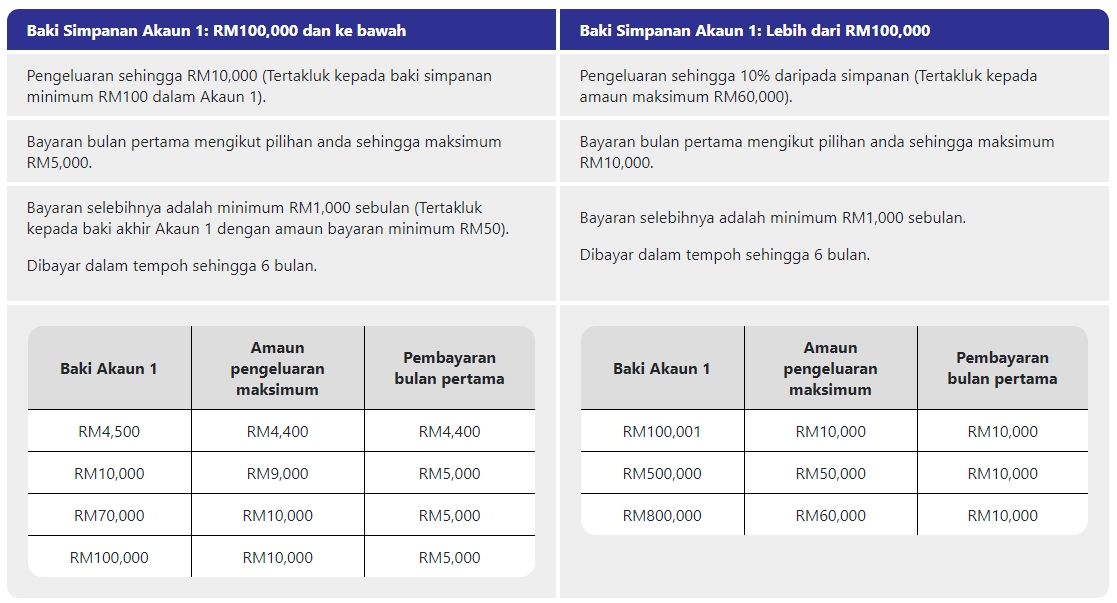

Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000. EPF i-Sinar withdrawal gives positive immediate impact to real economy The Employees Provident Fund EPF logo is seen at its headquarters on Jalan Raja Laut January 22 2020. Use the slider to set your preferred withdrawal amount from Account 1.

Visit the official iSinar portal at httpsisinarkwspgovmy. However the amount withdrawn will be subject to the account balance. The unconditional withdrawals under the Employees Provident Funds EPF i-Sinar facility is expected to provide an immediate positive impact to the economy in terms of consumption said Bank Negara Malaysia BNM deputy governor Datuk Abdul Rasheed Ghaffour.

Malaysians are rejoicing as the government has agreed to approve another withdrawal of Employees Provident Fund EPF savings of RM10000. BN can still reject Budget 2021 if EPF withdrawal is complicated Najib. I-Sinar to help them survive.

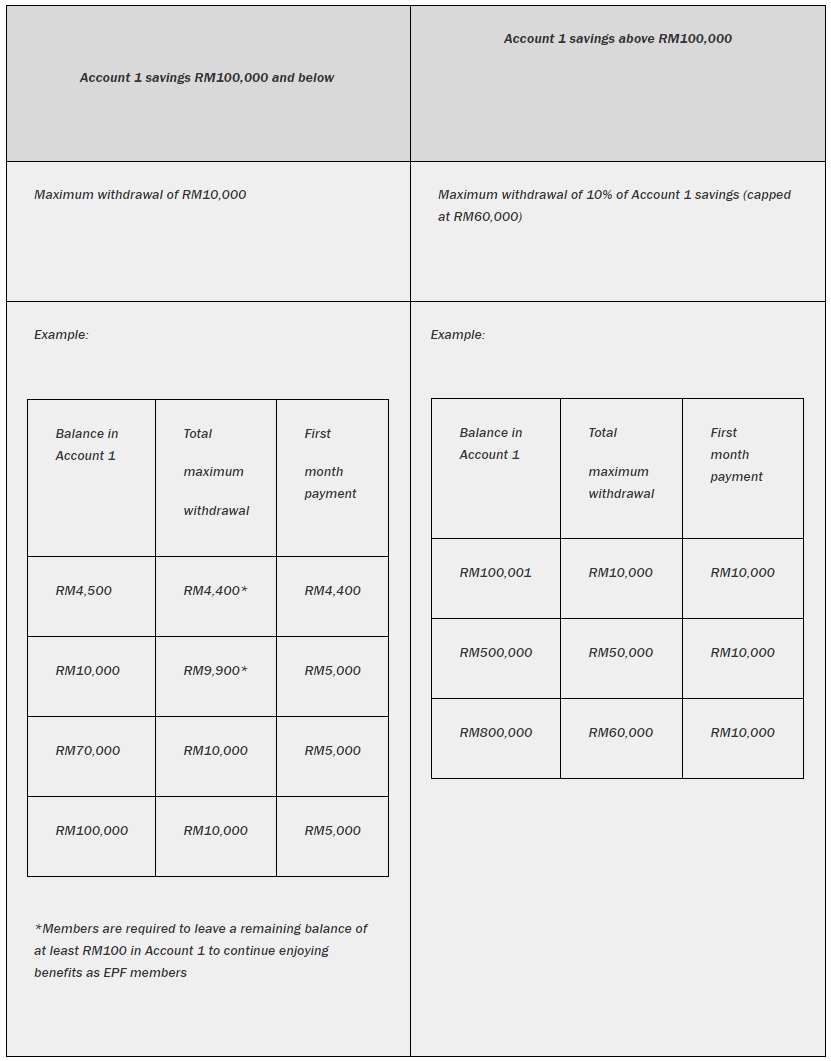

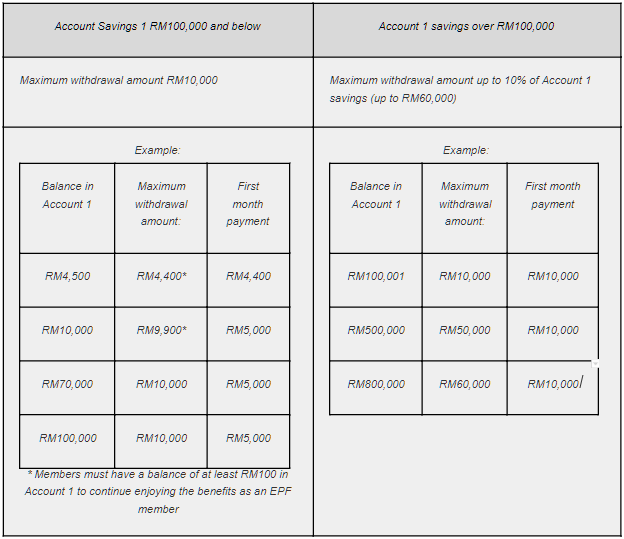

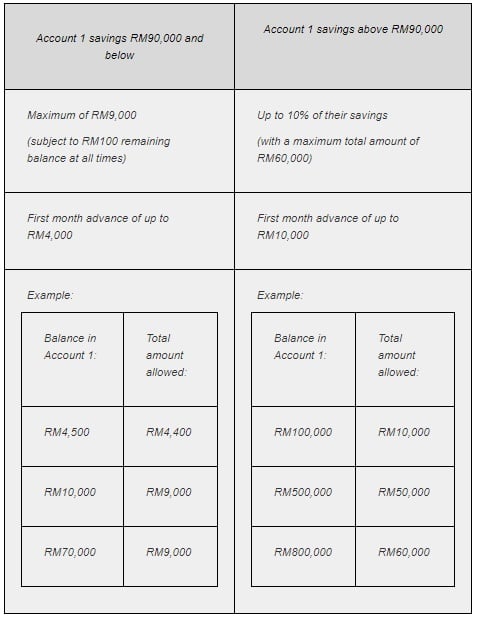

This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. 63 million EPF members have less than RM10000 left in their EPF Account 1. The actual amount that you can withdraw under the i-Sinar facility depends on whether you have more or below than RM100000 savings in your Account 1.

Malaysia Bank Negara. All EPF members can withdraw from Account 1. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently. Applications start from 21 Dec 2020. EPF CEO to bring proposal on abolishing TC for i-Sinar to Tengku Zafrul.

Enter your IC and mobile number. 01 May 2021 Partial Withdrawal Age 50. Do not assume BN wants to topple the government Asyraf Wajdi 5 months of darkness may i-Sinar brighten up our lives.

An OTP will be sent to your mobile phone for verification or answer a security question. KUALA LUMPUR April 1. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old.

The government has announced an extension of its i-Sinar programme to allow all Malaysians to withdraw funds from Account 1 of the Employees Provident Fund EPF. According to EPF this caused 61 million members to have less than RM 10000 in their savings and a. As of March 2021 as many as 594 million members have benefited from the i-Sinar programme with withdrawals of RM5248 billion approved.

1Withdraw 20k i-sinar 2Follow TS stock purchase recommendation 3Bursa open all in 4Google search top 10 places to 14th floor. EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat. The withdrawals under the EPFs i-Sinar scheme is seen to have a positive immediate impact on the real economy as it supported domestic consumptions.

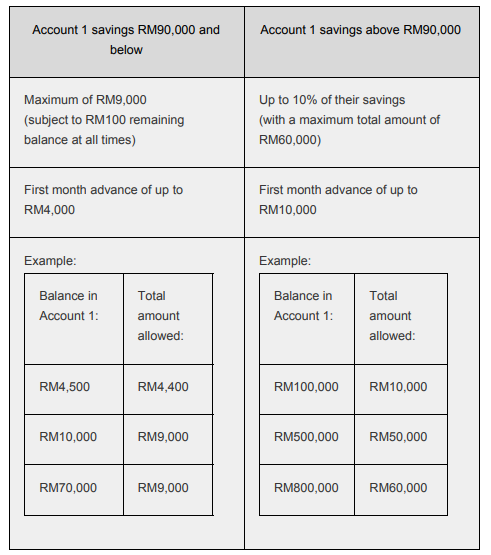

The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties.

The move will involve some RM70 billion from the. Affected members who wish to take out funds are able. However statistics on the recent withdrawals by EPF members paint a grim picture for the future.

The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. A Account 1 savings RM100000. The move will benefit some eight million EPF contributors Finance Minister Tengku Zafrul Aziz said in the Dewan Rakyat today.

You can choose how much to withdraw in the first payout but the subsequent payments must be at least RM1000 per month. For those who have. The i-Sinar program was introduced to assist members who are affected by the current pandemic situation.

During the past two years Malaysians have been allowed to make several rounds of withdrawals from their EPF savings through i-Lestari i-Sinar and i-Citra schemes which resulted in a withdrawal of RM 101 billion by 74 million members. For those with they can withdraw any amount up to RM10000. Jun 7 2021 1020 AM updated 2y ago.

In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available. Partial Withdrawal Full Withdrawal Home Member Withdrawals Last updated.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Announces Terms For I Sinar Withdrawal

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

Here S How You Can Get Access To Your Epf Account 1 Hr News

I Sinar A Rm56bil Question Mark The Star

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Akaun 1 Advance Facility What You Need To Know

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

I Sinar Category 2 How To Apply And Eligibility Comparehero

Need To Withdraw More Funds Epf I Sinar Applications Can Now Be Amended Online

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Account 1 Withdrawal I Sinar The Pros And Cons

I Sinar 8 Other Things You Can Use Your Epf For

Why I Sinar Went Wrong And Why Epf Contributors Shouldn T Be Treated Like White Knights Consumers Association Penang

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

Pm Ismail Sabri Malaysians Can Withdraw Rm10 000 From Epf

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

0 Response to "epf withdrawal i sinar"

Post a Comment